There’s NEVER Been a Better Time for Charitable Gifting

How would you like to give a million dollars to charity… and your children also get $1.3 million?

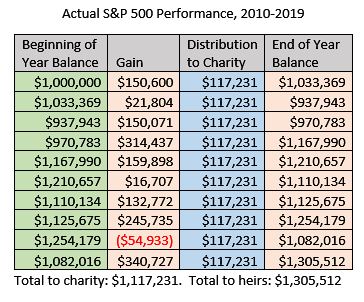

Sounds too good to be true, doesn’t it? But for someone who set up a ten -year Charitable Lead Annuity Trust (CLAT) on January 1st, 2010, that is exactly what would have happened. The best part is, that million-dollar gift would not have used up any of the donor’s Lifetime Exemption, so there would be no gift or estate tax.

A Charitable Lead Annuity Trust is a type of charitable trust, where a charity (the lead beneficiary) gets annual payments, either for a fixed number of years, or for the donor’s lifetime. At the end of this period, any remaining assets in the Trust are distributed to the CLAT’s non-charitable beneficiaries, which are typically the donor’s descendants (or trusts for their benefits).

Because only part of the gift goes to charity, and part of the gift goes to the descendants, part of the gift is tax-deductible. The IRS has a formula for what percentage is tax deductible, based on how much goes to charity and what the expected growth is for the assets. That expected growth rate is called the “7520 Rate” (named after that section of the Tax Code), and the lower that rate is, the better the benefits of a CLAT. By adjusting the amount that goes to charity, it’s possible to “zero out” the CLAT so that the entire amount of the gift is tax-deductible. Generally speaking, if the investments grow at a greater rate than the 7520 Rate, the excess will go to your heirs.

Back in January 2010, the 7520 Rate was 3.00%, which means that for a $1 million donation to a ten-year CLAT be entirely deductible, $117,231 would have to be donated to charity every year for ten years. Afterwards, anything left over in the CLAT would go to the non-charitable beneficiaries. If the funds had been invested in the S&P 500, the average rate of return was around 14%, which is significantly more than the 3.00% required by the IRS. In the charts below you can follow the performance of assets

At the time of writing, the 7520 Rate is 2.25%. For the past century, the average stock market return is 10% per year, and at that rate, with a 10-year CLAT your heirs would get around $800,000. Or, you could stretch it out for longer. A 15-year CLAT would net your heirs $1.65 million, and a 20-year CLAT would leave them $3.1 million.

To take advantage of the tremendous benefits of a CLAT before interest rates go up, please call us at (239) 791-7950 to set up a free consultation with the estate and tax planners at Aloia, Roland, Lubell & Morgan.

ABOUT ALOIA, ROLAND, LUBELL & MORGAN, PLLC

Aloia, Roland, Lubell & Morgan, PLLC is a full-service law firm with practice areas in business and real estate law, commercial litigation, personal injury and wrongful death, civil litigation, family law, estate planning and probate. Established in 2004 and led by senior partners, Frank Aloia, Jr., Ty Roland, Evan Lubell, Jack Morgan III, and partner, Danielle Levy Seitz, the firm has deep roots in Southwest Florida, proudly serving its community. Aloia Roland is headquartered at 2222 Second Street in downtown Fort Myers, Florida. Learn more at www.LawDefined.com or call (239) 791-7950.